Optimism about potential trade deals across certain countries has driven a turnaround Tuesday, with stocks jumping a whopping 4% intraday. Driving much of the enthusiasm was Wall Street veteran and Secretary of the Treasury Scott Bessent, who alluded to a long line of up to 70 nations that are impatiently waiting to reach the negotiating table with President Trump. And while a plethora of political leaders look to appease the US Commander in Chief to achieve some degree of tariff curtailment, Beijing seeks to go the other way, vowing to fight to the end. Against this turbulent backdrop, investors are scooping up shares in every equity sector, while forecast contracts and non-cyclical commodities are also catching bids. Meanwhile, on a quiet day for the economic calendar, rates are near their flatline, and traders are reducing their exposures to the greenback, copper and crude oil.

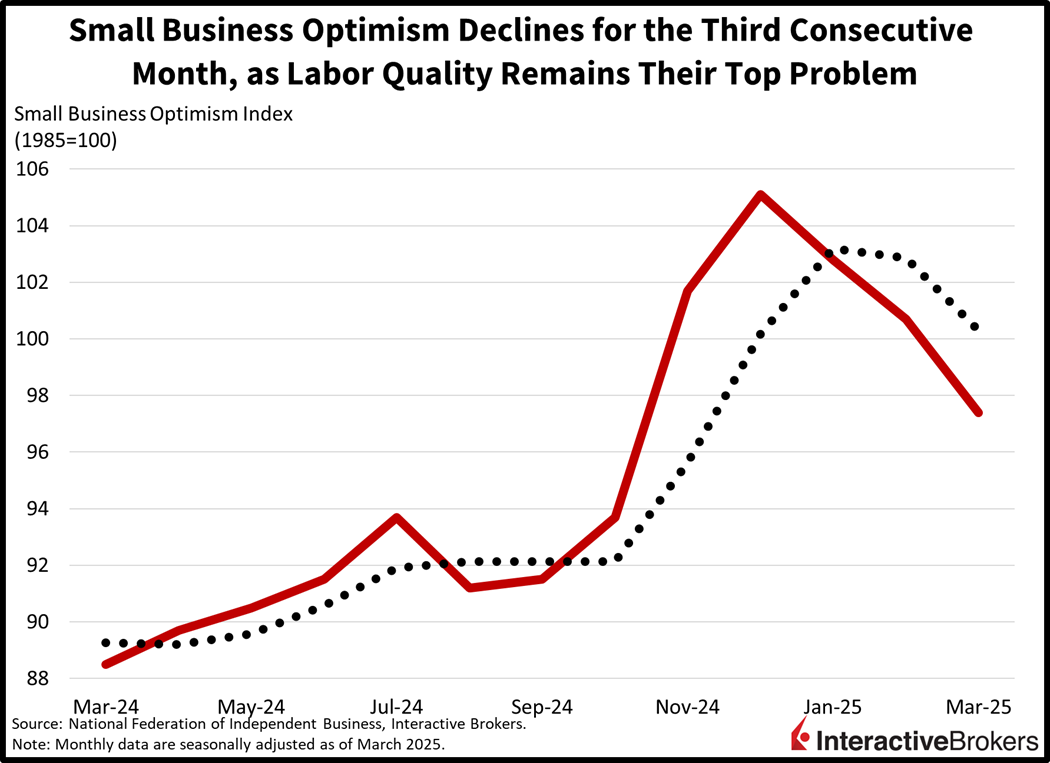

US Small Business Sentiment Slips

Shifting trade policy has worried some small business owners, and they have pared back their revenue expectations in light of the uncertainty. The National Federation of Independent Business’s (NFIB) Small Business Optimism Index slipped for the third consecutive month to 97.4 in March, beneath the median estimate of 101.3 and February’s 100.7. Broad declines across components contributed to the weaker result, but sharp drops in survey respondents who expect the economy to improve and project higher sales growth weighed on the headline. Moreover, earnings trends, capital expenditure plans, and hiring initiatives also slowed but at much more modest degrees. As far as the most important problems that establishments are facing, labor quality, identified by 19% of respondents, was the most common, followed by taxes, inflation and employee compensation, which were cited by 18%, 16% and 11% of companies.

Equities Recover

Stocks are posting an impressive turnaround Tuesday with every major equity benchmark and sector achieving sizeable gains. The Nasdaq 100, Dow Jones Industrial, S&P 500 and Russell 2000 are advancing by 2.8%, 2.5%, 2.4% and 1.6%. All eleven segments are in the green and financials, technology, and industrials are leading; they’re climbing 3.2%, 3.1% and 2.6%. In fixed-income and currencies, Treasurys are nearly flat as the 2- and 10-year maturities change hands at 3.79% and 4.20% while the Dollar index sheds 18 basis points. The greenback is depreciating relative to the pound sterling, franc, yen, loonie and Aussie tender, but it is appreciating versus the euro and yuan. Commodities are mixed, however, as gold, lumber and silver trade higher by 0.6%, 0.4% and 0.2%, but copper and crude oil are down 3% and 0.4%.

The Long-Term Benefits of Onshoring

With wide-ranging tariffs being implemented at midnight, traders are patiently waiting for collaboration across some major US trade partners. I suspect the White House is trying to get a deal or two completed in short order to quell asset volatility and support investor sentiment and economic stability. But the negotiations with Beijing won’t be done anytime soon as the nation is firmly committed to remaining the world’s number one manufacturing destination. Furthermore, confrontations between Trump and Xi offer somewhat of a déjà vu for market participants, who recall the enduring rivalry that persisted during the former’s first-term spanning from 2017-2021. I expect certain difficulties to be reconciled in the next few hours and days, but the grapple with China won’t be a one-week, or two-month ordeal; it may span the entire four-year presidential interval. In conclusion, investors that can weather this turbulent period of economic and financial market shakiness will likely benefit over the long haul, when the tailwinds of the Trump policy mix take center stage in a few months and the positive results of onshoring initiatives deliver a new age of diversified growth amidst a manufacturing renaissance in the United States of America.

International Roundup

Consumer Sentiment Drops in Australia

Australians are increasingly dour about the economy as depicted by the Westpac-Melbourne Institute Consumer Confidence Index dropping 6% this month to 90.1 after hitting 95.9 in March. Concerns about tariffs were a significant factor. Sentiment is still stronger than in April of 2024 with the benchmark up 9.3% y/y.

During the week in which consumers were surveyed, Australians who completed questionnaires prior to President Trump announcing a 10% levy on imports from the country scored only a smaller m/m decline with a sentiment level of 93.9. Conversely, individuals surveyed after the announcement generated a nearly 10% drop to 86.6. Capital market turmoil has also weighed on Australians’ sentiment. Within the index, all five subcomponents recorded the following m/m declines:

- Family finances versus a year ago, 8.5%

- Family finances next 12 months, 6.2%

- Economic conditions next 12 months, 5.7%

- Economic conditions next 5 years, 3%

- Time to buy a major household item, 7.3%

Sentiment Also Falls Among Businesses

The NAB Business Confidence Index fell from -2 to -3 in March, a four-month low, but since the result was compiled prior to the US announcing sweeping tariffs, it doesn’t reflect entrepreneurs’ concerns about trade protectionism, according to the National Australia Bank. On the other hand, a gauge tracking current business conditions climbed modestly from 3 to 4. Among the NAB data, capacity utilization climbed from 82% to 82.9%, reflecting increased demand for the mining segment, the transport and utilities group and construction and manufacturing. Utilization was unchanged in consumer facing segments. With confidence and current conditions sentiment below average, businesses have embraced a cautious outlook.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!