Your Weekly Roadmap with Jay Woods, CMT

1/ T-Day (Take Two)

2/ A Manic Monday?

3/ VIX Over 40

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

T-Day (Take Two)

UNCERTAINTY…

No, this isn’t last week’s newsletter – it just rings louder today. Only this time it screams from a valley that is 10% lower than where we mentioned it last week.

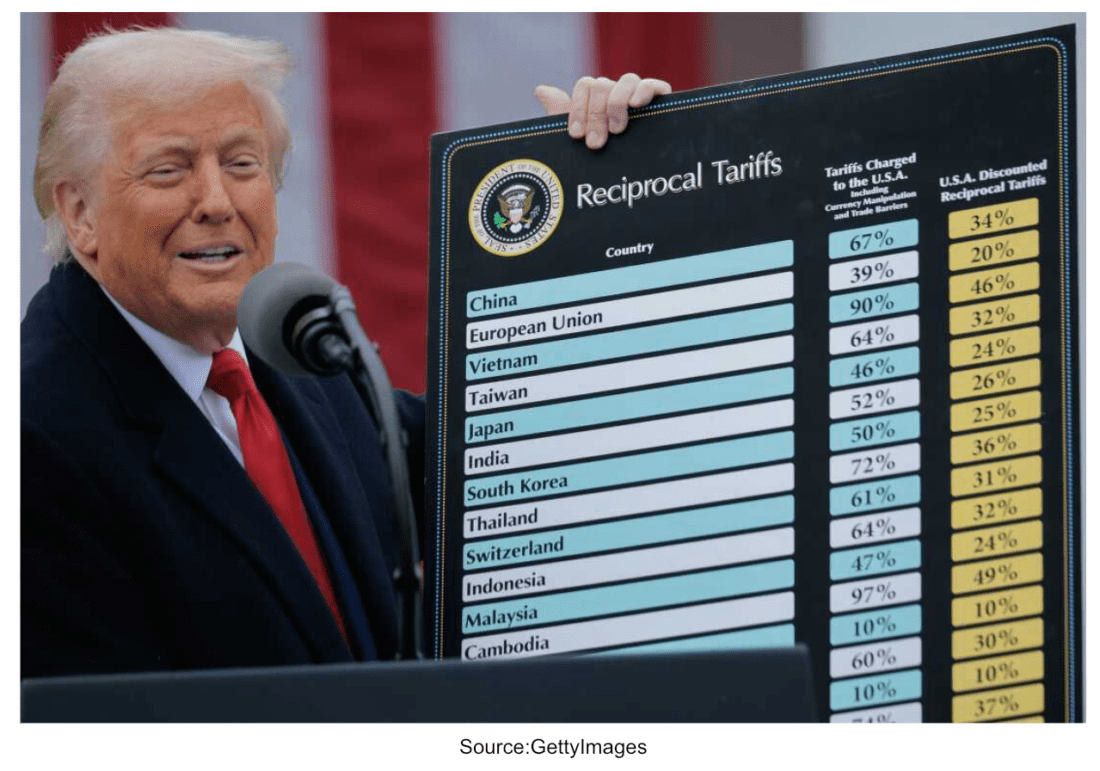

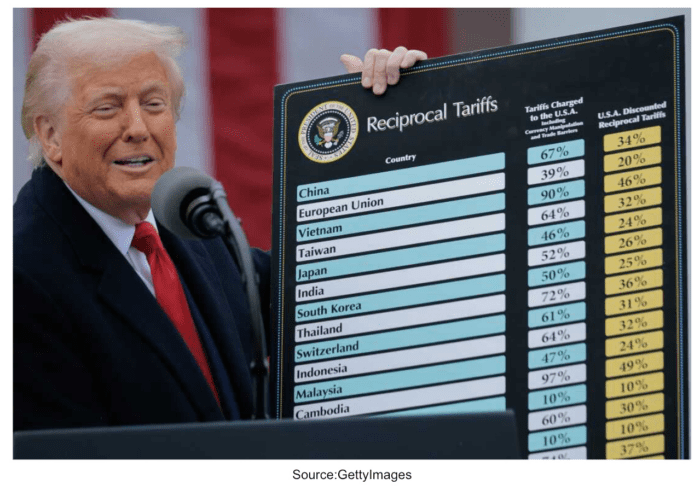

“Liberation Day” came and went and it turned into more of a “Liquidation Day” as the tariffs implemented were far worse than had been projected.

The market spoke and didn’t like what it heard out of Washington. I discussed that immediate reaction on Thursday with NYSE TV Live here and here on CNBC last Friday.

Now we wait again after suffering back-to-back days of historical losses in the S&P 500. The only other times, going back to the inception of the current S&P 500 in the early 1950’s, the index lost over -10.3% or more over two consecutive trading days were in 2020 (Covid), 2008 (Great Financial Crisis) and 1987 (Stock Market Crash).

Traders will be watching the newswire and social media feeds for headlines all week. Let’s see what comes of the next tariff deadline when things are to be implemented on April 9th.

T-Day (Take Two). Let’s try this again. Last week we hoped the event on April 2nd would give the market and its participants clarity. What we got were deeper and more widespread tariffs than anyone expected and, as a result, thrown right into a major trade war.

The numbers shocked even the most pessimistic among us as they were far worse than anything anticipated. Questions about the math behind it still linger and confuse most top economists.

Will things get walked back? Will this lead to fruitful negotiations among those on the list?

So far China has reciprocated with tariffs of their own and Vietnam wants to negotiate. It feels like a game of chicken and the American investor is the passenger on this crazy car ride.

2/

A Manic Monday?

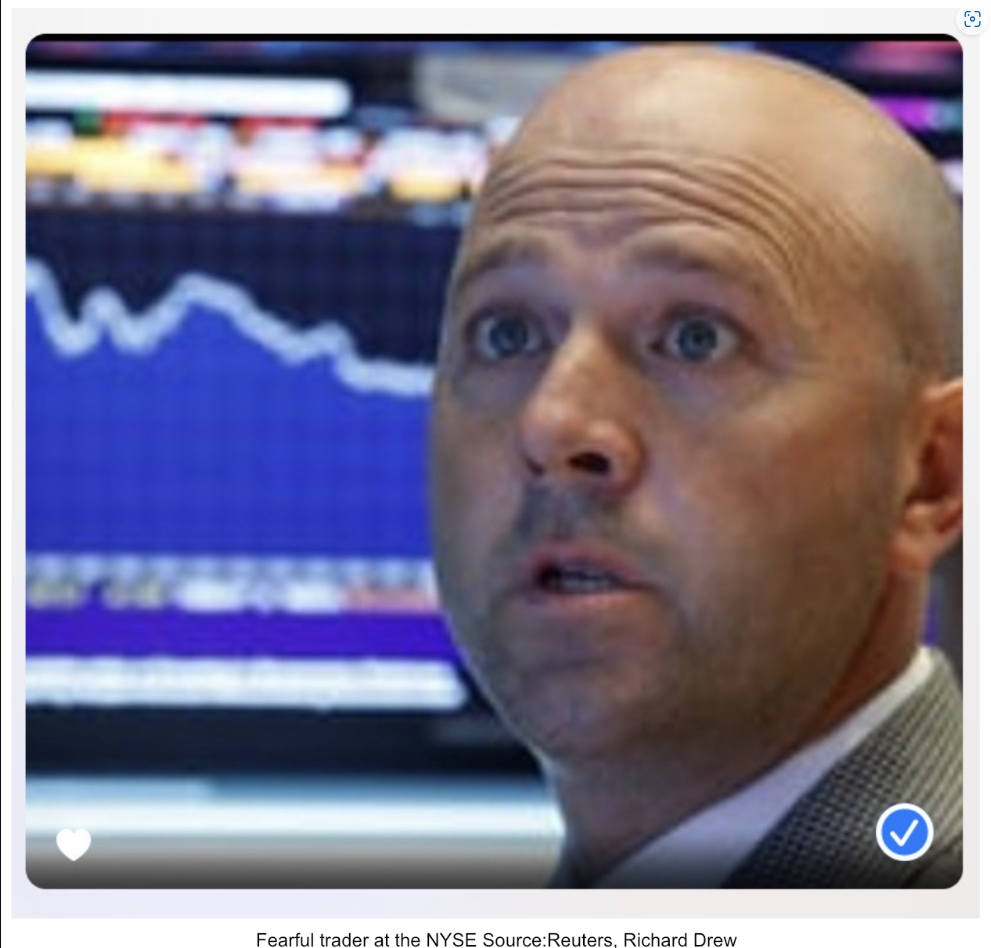

Manic Monday? When you look at market history and other crises, none have been more avoidable and self-inflicted as this current crisis.

The markets closed on the lows over the last two days leaving us susceptible to a far greater panic if nothing is resolved or at least tempered by Monday’s opening. Traders will be monitoring circuit breaker levels to watch for potential thresholds that may cause a halt in trading.

I will post those levels to my Twitter page on Monday morning for those that want exact numbers. We have yet to see a 7% threshold breached since Covid when they triggered four times at the 7% level.

If we hit a circuit breaker of 7% and 13% we pause trading for 15 minutes. If we hit the 20% threshold then we close immediately. After 3:25, only a 20% drawdown will stop trading.

If you want to win a bet with someone, bet them that we will never see the likes of October 16th, 1987’s Black Monday again. That day the S&P 500 fell -20.4% and given the rules of today we stop at -20%. The Dow, however, fell -22.6% (507.99 points) and could surpass that given that index of 30 stocks is not involved in the circuit breaker.

3/

VIX Over 40

VIX over 40! The VIX is also known as the fear index. When it hits historical extremes it is generally a sign of near capitulation and a potential market bottom. Let’s look at some instances where the VIX traded over 40*.

October 2008 – Global Financial Crisis

VIX Peak: 89.53 on October 24, 2008

S&P 500 Bottom: Not until March 2009, but…mini bottom. After the October VIX spike, markets bounced short-term. Capitulation waves occurred multiple times.

Nota Bene – VIX remained elevated above 40 for months during the crisis. It wasn’t a single spike event.

August 2011 – U.S. Debt Ceiling / Europe Debt Crisis

VIX Peak: 48.00 on August 8, 2011

S&P 500 Capitulation: Around 1,100, followed by a bottoming process into October.

Context: S&P downgraded U.S. credit rating. Sharp drop in equities led to VIX surging. Markets stabilized in the following weeks.

February 2018 – Trump tariffs / China / Eagles Super Bowl Victory

VIX Spike: 50.30 on February 6, 2018

S&P 500 Drop: 10% correction, bottomed near 2,530

VIX spike marked the exact low.

March 2020 – COVID Crash.

VIX Peak: 82.69 on March 16, 2020

S&P 500 Bottom: 2,237 on March 23, 2020

Context: Pandemic fears, economic shutdowns. The spike in the VIX came just before the final flush lower in stocks. Markets began recovering shortly after.

August 2024 – Japan Yen Carry Trade

VIX Spike: 65.73 on August 5th, 2024

S&P 500 dropped -9.8%, S&P bottomed at 5119.26

Spike coincided with a noticeable near-term low only to be broken last Friday

*Credit – Bloomberg data and Freedom Capital Markets research

Currently this is quite similar to 2018 headline-wise. We shall see how it shakes out and history deems it.

The reality of current market action is that some of the biggest rallies one can experience are with a high VIX and stocks trading below their 200-day moving averages. That set-up is in place for a quick rip-your-face-off rally. The question is – can one catch this falling knife? If one does, the quick snap back rally could be quite rewarding.

Continue Reading on Freedom Capital Markets…

—

Originally posted 8th of April 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!