Your Privacy

When you visit any website it may use cookies and web beacons to store or retrieve information on your browser. This information might be about you, your preferences or your device and is typically used to make the website work as expected. The information does not usually directly identify you, but can provide a personalized browsing experience. Because we respect your right to privacy, you can choose not to allow some types of cookies and web beacons. Please click on the different category headings to find out more and change our default settings. However, blocking some types of cookies may impact your experience on our website and limit the services we can offer.

Strictly Necessary Cookies

Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems. They are typically set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in or filling in forms. While you can set your browser to block or alert you about these cookies, some parts of the website will not work. These cookies do not store any personally identifiable information.

ALWAYS ACTIVE

Functional Cookies

Functional cookies enable our website to provide enhanced functionality and personalization. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies then some or all of these services may not function properly.

Marketing Cookies and Web Beacons

Marketing Cookies and web beacons may be set through our website by our advertising partners. They may be used by those companies to build a profile of your interests and show you relevant adverts on other websites. They do not directly store personal information, but uniquely identify your browser and internet device. If you do not allow these cookies and web beacons, you will experience less targeted advertising. Our website does not track users when they cross to third party websites, does not provide targeted advertising to them and therefore does not respond to "Do Not Track" signals.

Interactive Brokers Group Cookie Policy

What are Cookies and Web Beacons?

Cookies are pieces of data that a website transfers to a user's hard drive for record-keeping purposes. Web beacons are transparent pixel images that are used in collecting information about website usage, e-mail response and tracking. Generally, cookies may contain information about your Internet Protocol ("IP") addresses, the region or general location where your computer or device is accessing the internet, browser type, operating system and other usage information about the website or your usage of our services, including a history of the pages you view.

How We Use Cookies and Web Beacons

Interactive Brokers Group collects information from cookies and web beacons and stores it in an internal database. This information is retained in accordance with our Privacy Policy. This website uses the following cookies and web beacons:

Strictly Necessary Cookies

These cookies are necessary for the website to function and cannot be switched off in our systems. They are usually only set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in or filling in forms. You can configure your browser to block or alert you about these cookies, but certain areas of the site will not function properly. These cookies do not store any personal data.

Performance Cookies and Web Beacons

These cookies and web beacons allow us to count visits and traffic sources so we can measure and improve the performance of our site. They help us to know which pages are the most and least popular and see how visitors move around the site. All information that these cookies and web beacons collect is aggregated and, therefore, anonymous. If you do not allow these cookies and web beacons our aggregated statistics will not have a record of your visit.

The website uses Google Analytics, a web analytics service provided by Google, Inc. ("Google"). Google Analytics uses cookies to help analyse how you use this website. The information generated by the cookie about your use of this website (including your IP address) will be transmitted to and stored by Google on servers in the United States. Google will use this information for the purposes of evaluating your use of the website, compiling reports on website activity for website operators and providing other services relating to website activity and internet usage. Google may also transfer this information to third parties where required to do so by law, or where such third parties process the information on Google's behalf. Google will not associate your IP address with any other data held by Google.

Functional Cookies

These cookies enable the website to provide enhanced functionality and personalization. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies, some or all of these services may not function properly.

Marketing Cookies and Web Beacons

These cookies and web beacons may be set throughout our site by our advertising partners. They may be used by those companies to build a profile of your interests and show you relevant advertisements on other sites. They do not store personal information that could identify you directly, but are based on uniquely identifying your browser and internet device. If you do not allow these cookies and web beacons, you will experience less targeted advertising. The website does not track users when they cross to third party websites, does not provide targeted advertising to them and therefore does not respond to Do Not Track ("DNT") signals.

Managing Your Cookie Preferences

You have many choices with regards to the management of cookies on your computer. All major browsers allow you to block or delete cookies from your system. However, if you do decide to disable cookies you may not be able to access some areas of our website or the website may function incorrectly. To learn more about your ability to manage cookies and web beacons and how to disable them, please consult the privacy features in your browser or visit www.allaboutcookies.org.

This website may link through to third party websites which may also use cookies and web beacons over which we have no control. We recommend that you check the relevant third parties privacy policy for information about any cookies and web beacons that may be used.

Thank you

Thanks for engaging!

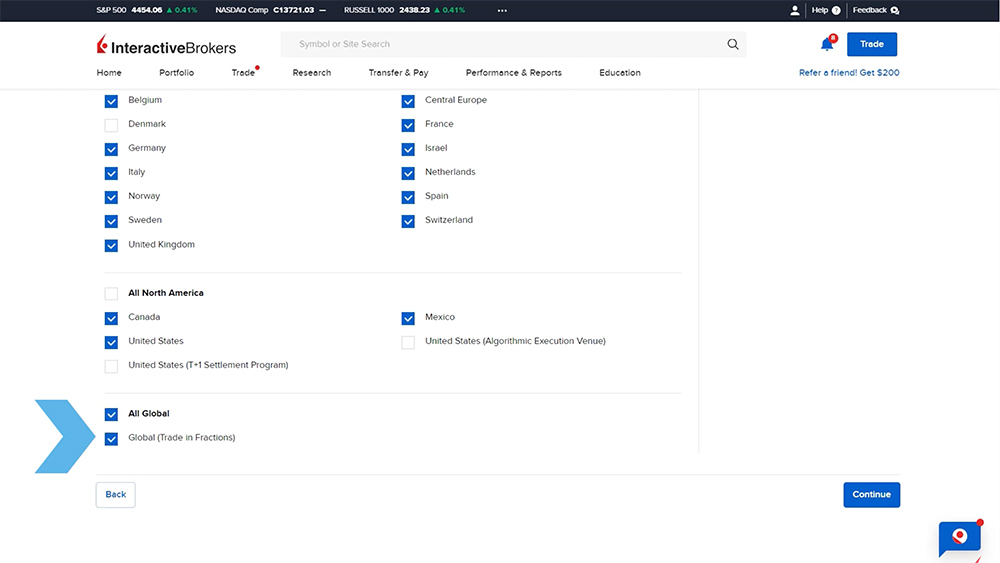

I have an IBKR Pro account. I don’t seem to be able to enable fractional share trading permission. Is this option available to everyone in all countries?

Hi, thank you for your question. Please review fractional share eligibility in this FAQ:

https://www.ibkr.com/faq?id=83262092

You can also find more details here:

https://ibkr.info/node/3416

We hope this helps answer your question!

If I want say .25 shares of one stock or .50 shares of a stock in that exact amount, is that possible? I don’t want odd amounts of fractional shares.

Thank you for asking. Yes, it is possible to enter fractional shares for specific amounts. We hope this answers your question!

Can we convert all the fractional share of a company into whole share

Eg : if we have 3 fractional share like 0.25 % , 0.50% , 0.25% . It will automatically convert into 1 whole share ?

Hello Satish, fractional shares will automatically convert into whole shares if you have enough fractional pieces to add up to a whole number. Please reach back out with any additional questions. We are here to help!

Hello.

Is this true for European ETFs as well?

Will fractional portions of an European ETF automatically convert into one whole unit, once they add up?

Thank you in advance.

Thank you for asking. Yes, this is also true for ETFs. We hope this answers your question!

Thanks for getting back to me and clearing that up.

If after investing for some time we reach the point that we accumulate enough to own a whole share or ETF, is that share or ETF than tranferable to another broker or can only be liquidated? Thank you in advance!

Hello, thank you for reaching out. Fractional shares will automatically convert into whole shares if you have enough fractional pieces to add up to a whole number. IBKR does not accept fractional shares through a position transfer. https://www.interactivebrokers.com/faq?id=61921218

However, if it accumulates to a whole share, you should be able to make a position transfer. Please reach back out with any additional questions. We are here to help!

hi. Do you plan to make it accessible via API (e.g. with python code)? Currently it doesn’t seem possible.

Thank you for reaching out. Fractional trading is supported via FIX/CTCI but not via API at this time. Please view this FAQ for more information: https://www.interactivebrokers.com/faq?id=84637087

Please review this FAQ on where you can leave your feedback, and submit any specific suggestion(s) on how we can improve:

https://www.ibkr.com/faq?id=32653353

You can also post in the Feature Poll in Client Portal where other IBKR users can comment and vote:

https://portal.interactivebrokers.com/portal/#/suggestions

What happens to dividends paid out fractional shares, for example if you have 0.5 share of a dividend that pays out 1USD do you also receive 0.5USD

Thank you for asking. Your fractional shares positions are eligible to receive dividends in the same manner as your full positions on the same stocks. The formula is the position quantity multiplied by the dividend rate (ie. 0.85 shares x 0.75 dividend rate = $0.6375). https://www.interactivebrokers.com/faq?id=84609891

Not sure but I believe extra ECN fees may be charged when using fractional shares…something to look out for.

Thank you for reaching out. Please view more information on the fees associated with fractional shares in the FAQ below:

https://www.interactivebrokers.com/faq?id=84637057

Hi, just wanted to ask what happens if I disable fraction share feature:

1. if I have existing fraction shares, will I able to sell the fraction shares?

2. I have recurring investment setup, will these recurring investment be buying whole shares instead of fraction shares?

Thank you for reaching out. If you disable fractional share trading, you will still be able to sell any existing fractional share positions in your account. For any recurring investments that were previously purchasing fractional shares, disabling this feature will result in those investments purchasing whole share quantities going forward. We hope this answers your question!

Can I trade fractional shares using any type of order, especially stop order?

Thank you for reaching out. Yes, stop orders can be used with fractional shares. Please view this FAQ for more information:

https://www.interactivebrokers.com/faq?id=92012440

We hope this helps!

Does Interactive Broker support Fractional Stock purchase of VOO ETF?

Thank you for asking. You can view a list of eligible U.S., Canadian and European stocks and ETFs, where available here: http://www.ibkr.com/download/fracshare_stk.csv

Please review this FAQ for more information: https://www.interactivebrokers.com/faq?id=83257314

We hope this helps!

May I know IBKR will charge how many money on fractional share?

Thank you for asking. Please view this FAQ for information on the fees associated with fractional shares: https://www.interactivebrokers.com/faq?id=84637057

I’m still not sure how this works on technical level. What it means in fact on technical level when I own some fraction of a share? Consider a scenario of buying multiple times fractions of share X, let’s say I’ll buy 0.7 of a share X, then 0.5 share of X and afterwards 0.9 of share X. Then technically I have 2.1 of share X. Does this mean that I own 2 shares as if I would buy them as 2 shares X (fully, not as fractions, and listed as the sole beneficial owner of those two shares) and on top of that I somehow “own” 0.1 of share X, e.g., listed among multiple beneficial owners of some other share? Or is it that I’m listed as beneficial owner on three different shares and for each I own 0.7, 0.5 and 0.9 fractions respectivelly? Thanks for info!

Thank you for reaching out. Fractional shares will automatically convert into whole shares if you have enough fractional pieces to add up to a whole number. Please reach back out with any additional questions. We are here to help!

Does that mean we will also receive the same rights as whole shares if we have enough fractional shares to be converted to whole shares?

Yes, this means you will receive the same rights.

I still quite don’t understand how “strong” my ownership of shares is when trading fractions. Consider following scenario – I’ll buy 0.7, 0.5 and 0.9 of the same share in three different trades. Does it mean that after that I’m beneficiary owner of 2 complete shares + own 0.1 of another share, so my situation would be in effect the same as buying 2 shares in a single trade + 0.1 of the share in another trade? Or in given scenario I’m don’t own any share fully, just 0.7 of one share, 0.5 of another share and 0.9 of the third share? Thanks for explaining!

Thank you for reaching out. In this situation, this would be equivalent to 2 full shares plus an additional .1 of the share. We hope this clarifies things!

It’s all clear now. Thanks!

Hi, I’ve checked your link for the commissions charged on the fractional shares, however it seems to only cover the USD and CAD securities. For European UCITS – ETFs, what are the comissions exactly? Thank you. Berk

Hello, thank you for asking. You can review our Commissions for Fractional European ETFs here: https://www.interactivebrokers.com/en/pricing/commissions-stocks-europe.php?re=europe

We hope this helps!

Hi, in total there 47236 stocks traded on ibkr as of today. How many of them are eligible for fractionary trading?

Hi Alex, thank you for asking. You can view what Products can be traded in fractions on this FAQ: https://www.interactivebrokers.com/faq?id=83257314

We hope this helps!

Do u have a list of all fractionary traded shares. In the list of products, there is no specification whether they are eligible or not

Hello, thank you for asking. You can view what Products can be traded in fractions on this FAQ: https://www.interactivebrokers.com/faq?id=83257314

We hope this helps!

Hi, I had enabled the fractional share permissions in the Stock configurations, but I’m still unable to perform any fracquinal operation. Do you know if there’s a time I have to wait before it gets totally enabled ?

Hello, thank you for reaching out. Please view this FAQ for instructions to request trading permissions for fractional shares: https://www.interactivebrokers.com/faq?id=23299006

Trading permission requests are forwarded for Compliance Officer review. Please allow time for the completion of the due diligence checks and trading permission review. IBKR is trying to review as many trading permission upgrades as possible given the current environment.